A Study on the Impact of Economic Trends in 2009 and Their Long-Term Effects on Society

The Impact of the Financial Crisis on Global Economies A Reflection on 2009

In 2009, the world was grappling with the aftermath of the most significant financial crisis since the Great Depression of the 1930s. Originating in the United States with the collapse of major financial institutions due to exposure to subprime mortgages, the crisis quickly spilled over into global economies, leading to unprecedented economic turmoil. While the immediate effects were stark, the long-term implications of the crisis are still felt today, influencing policies, economics, and societal dynamics worldwide.

The financial crisis, initiated by the housing market collapse in 2007-2008, revealed the vulnerabilities in the global financial system. Financial institutions had engaged in reckless risk-taking, often driven by short-term profit motives, which led to a massive decline in asset values. As mortgage-backed securities plummeted, banks and financial institutions faced insolvency, triggering a cascade of failures. By 2009, many prominent banks in the U.S., such as Lehman Brothers, had declared bankruptcy, while others, like Bear Stearns and AIG, required government bailouts to stay afloat.

.

Governments and central banks responded with a range of measures to stabilize their economies. The United States implemented the Troubled Asset Relief Program (TARP), which allocated $700 billion to purchase distressed assets and inject capital into banks. The Federal Reserve also lowered interest rates and engaged in quantitative easing to stimulate economic activity. Similarly, the European Union introduced bailouts for member states while advocating austerity measures as a means to regain financial stability.

26099 09 2

While these interventions helped stabilize financial systems in the short run, they also sparked debates about fiscal responsibility and the role of government in the economy. Critics argued that the bailouts encouraged moral hazard, allowing institutions to take on excessive risks with the knowledge that they would be rescued if their bets failed. Others contended that austerity measures imposed on struggling economies stunted growth and led to social unrest, as seen in protests in countries like Greece and Spain.

The 2009 financial crisis profoundly influenced the discourse around economic policy and regulation. In the years that followed, there was a concerted global effort to reform financial regulations to prevent a repeat of such a catastrophic event. Initiatives like the Dodd-Frank Act in the United States aimed to increase transparency and oversight in the financial sector, mandating higher capital requirements for banks and implementing stress tests to ensure their resilience to economic shocks.

Moreover, the crisis highlighted the importance of sustainable economic practices. Policymakers began to acknowledge that economic growth should not only focus on GDP figures but also consider environmental sustainability and social equity. This shift has borne fruit in the current discourse around sustainable development and corporate responsibility, as seen in initiatives advocating for green finance and socially responsible investing.

In conclusion, 2009 stands as a poignant reminder of the fragility of our interconnected economies and the potential consequences of unchecked financial practices. The lessons learned from the crisis continue to resonate today, shaping economic policies and influencing global governance. The enduring impact of 2009 serves as a cautionary tale of the need for vigilance, regulation, and a commitment to creating a stable and sustainable economic future.

-

Water Treatment with Flocculant Water TreatmentNewsJun.12,2025

-

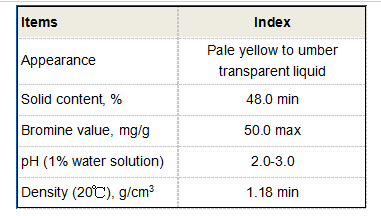

Polymaleic AnhydrideNewsJun.12,2025

-

Polyaspartic AcidNewsJun.12,2025

-

Enhance Industrial Processes with IsothiazolinonesNewsJun.12,2025

-

Enhance Industrial Processes with PBTCA SolutionsNewsJun.12,2025

-

Dodecyldimethylbenzylammonium Chloride SolutionsNewsJun.12,2025